Trade Every Tick

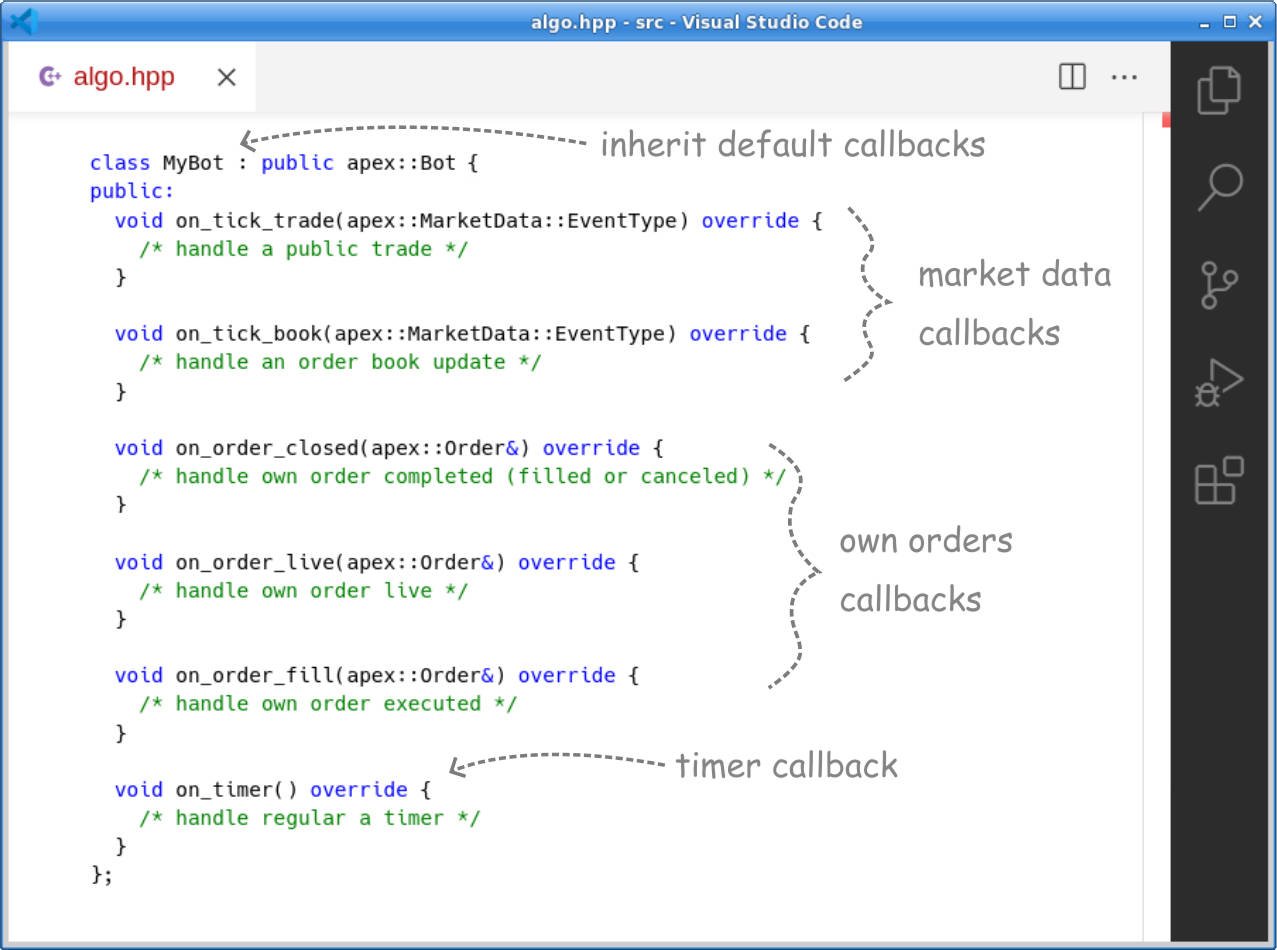

Our event based model simplifies even the most complex trading logic

event loop

Reactive event-loop based strategies that handle one event at a time.

data

Real-time trades & prices. Capture tick-by-tick and detailed order-book alpha.

orders

Respond instantly to your orders getting filled.